Understanding why people invest in art is vital to appreciating the unique qualities it offers

Art investment has been a longstanding avenue for individuals and institutions seeking to diversify their portfolios, preserve wealth, and generate financial returns.

Understanding why people invest in art is vital to appreciating the unique qualities it offers:

Diversification

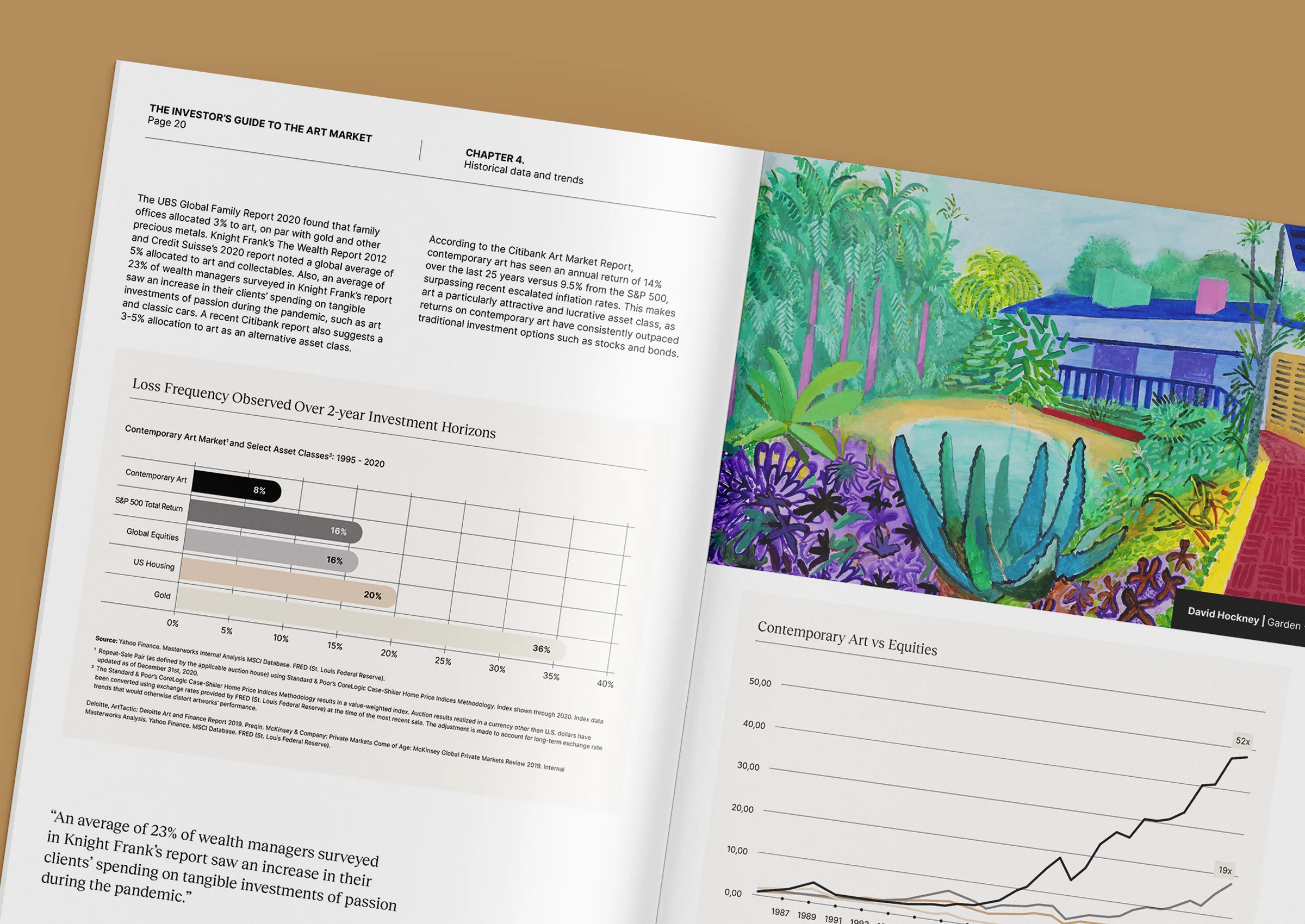

Art investment can diversify your portfolio beyond traditional assets like stocks and bonds. This diversification can help spread risk and protect your wealth from the volatility of financial markets. Unlike many financial assets, art’s value is often driven by factors outside the scope of economic performance, such as cultural and emotional significance.

Store of Value

Throughout history, art has proven to be a reliable store of value. Artworks are tangible assets that can withstand economic uncertainties and inflation. They often retain their value over the long term and, in some cases, appreciate significantly. Investors view art as a form of wealth preservation, with the potential for their holdings to maintain or increase in value over time.

Potential for Financial Returns

Art investment has the potential to offer financial returns that can outperform traditional asset classes. While past performance does not indicate future results, the art market has seen substantial appreciation in the value of specific artworks. Iconic pieces have fetched record prices at auctions, highlighting the potential for significant returns on investment.

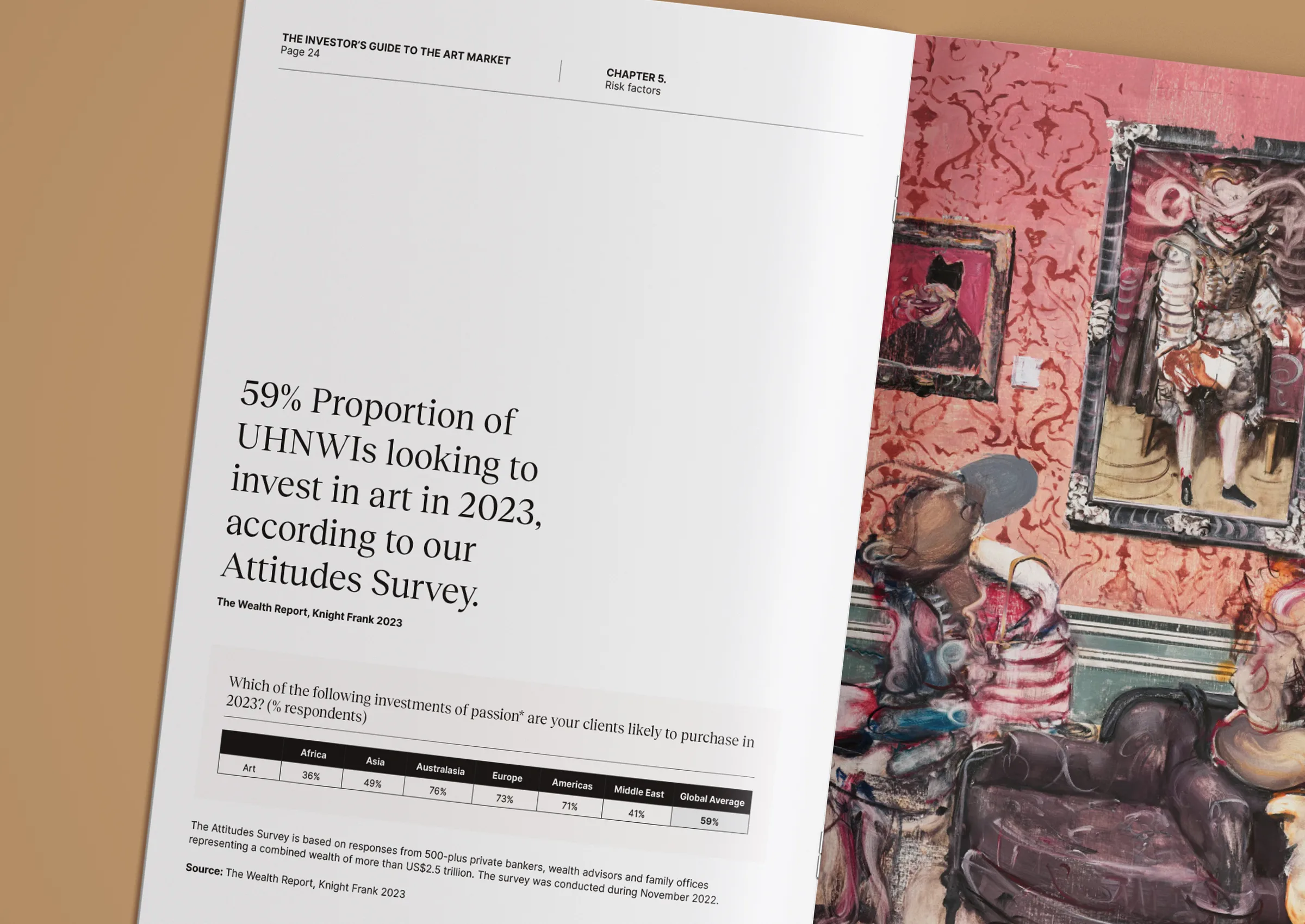

At the institutional level, we see four groups of significant investors in alternatives: large public funds, endowments, growth-oriented sovereign wealth funds, and family offices.

It has become increasingly common for big endowments to allocate 40% to 60% of their investments to alternative assets, as per the Alternative Investments Report by UBS Asset Management in December 2020. A recent survey revealed that global family offices allocate an average of 37% to various alternatives. Even mega funds such as large public pension plans and sovereign wealth funds have increased their alternative asset allocation. According to Blackrock Investment Management Research, the alternative asset allocation of global pension funds has risen from only 5% in 1996 to 26% as of 2019.

The decision to invest in alternative assets has led to better portfolio performance in terms of risk-adjusted returns. According to BlackRock Investment Management Research, alternative investments contributed 10% of returns with a 5% allocation in 1996. This figure has increased by five times in 2019. Despite having only a 26% allocation, alternative investments contributed almost half of the portfolio’s returns.

Looking to build your contemporary art portfolio?

To discuss how Zurani Advisory can assist you, please contact Benjamin Tomkins, Founder and Chief Executive Officer, Zurani. You can reach him via email at benjamin@zurani.com or telephone +971 58 593 5523.

THIS ARTICLE DOES NOT CONSTITUTE FINANCIAL, TAX OR LEGAL ADVICE AND SHOULD NOT BE RELIED UPON AS SUCH. TAX TREATMENT DEPENDS ON THE INDIVIDUAL CIRCUMSTANCES OF EACH CLIENT AND MAY BE SUBJECT TO CHANGE IN THE FUTURE. FOR GUIDANCE, SEEK PROFESSIONAL ADVICE.