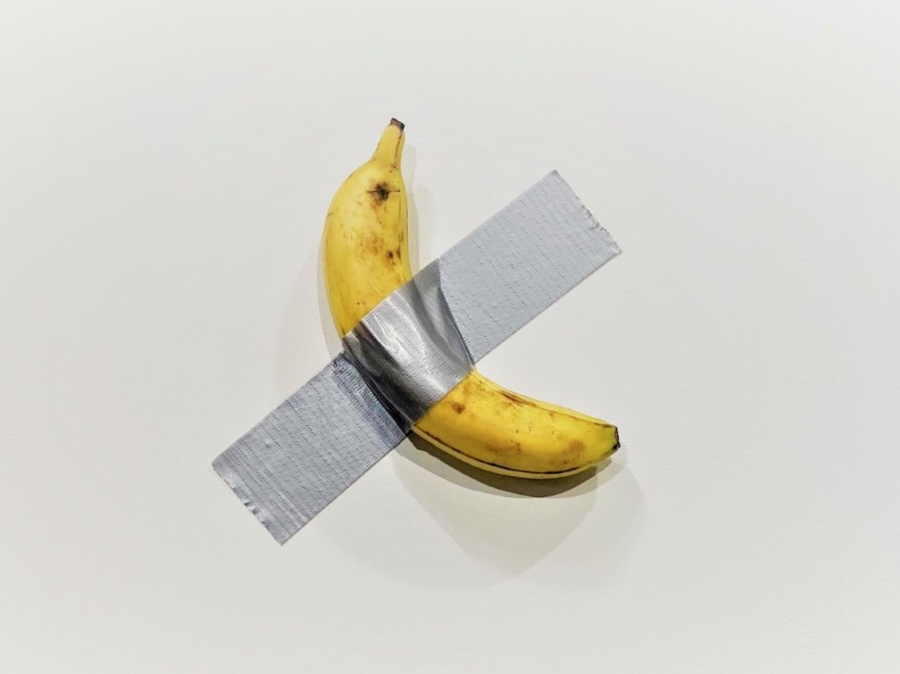

What a $6.24 million banana taught us about supply and demand

It was a banana, duct-taped to a wall. It sold for $120,000. Then again. And again. Eventually, the story of Comedian by Maurizio Cattelan reached a crescendo at $300,000, or so we thought. In late 2024, one edition resold at auction for over US$6.24 million [1].

What started as a conceptual joke at Art Basel Miami Beach became a parable of the contemporary art market. At first glance, it was absurd. But look closer, and it reveals how scarcity, storytelling, and speculation shape the value of art in the world.

At Zurani, we guide clients through the deeper mechanisms of cultural markets. Value is rarely just material. It’s emotional, historical, and contextual. And few works have exposed that more clearly, or more provocatively, than a banana taped to a wall.

How does it work in practice?

Despite appearances, Comedian was not a piece of fruit. It was a certificate of authenticity. Buyers weren’t acquiring a banana. They were purchasing the rights to recreate the work under specific instructions. The artwork would inevitably decay. But the value lived in the idea, the artist’s authorship, and the accompanying certificate.

Cattelan released just five versions, three editions and two artist proofs. In a world of infinite replication and visual noise, such deliberate scarcity adds weight.

Demand, however, wasn’t driven by form. It was driven by narrative. The Comedian went viral. It sparked public debate, press frenzy, and Instagram saturation. Collectors weren’t only buying art, they were buying into a cultural event.

In November 2024, that moment was reaffirmed when one edition sold at Sotheby’s New York for $6.24 million, including buyer’s premium [2]. The buyer, entrepreneur Justin Sun, then publicly ate the banana during a live event, underscoring the fact that the object was ephemeral, but the concept, and its value, lived on [3].

Key advantages and considerations

Cattelan’s banana might have been playful, but the market lessons it carries are profound.

For collectors navigating contemporary and conceptual art, it raises four essential insights:

Scarcity drives attention and price

Limiting production, whether through editioning or unique certification, can elevate demand. In traditional asset markets, scarcity functions similarly. But in art, it also builds mystique, adding emotional and cultural capital.

Demand often transcends logic

The art market, especially at the high end, is not purely rational. Social context, narrative, and perceived importance often outweigh aesthetic or material considerations.

Conceptual works reframe value creation

Comedian demonstrates how value can shift from an object to its authorship. What you’re buying isn’t necessarily what you can touch. Instead, you’re acquiring the legal and symbolic rights that attach to an idea.

Speculative interest can drive peaks, but long-term positioning is different

While viral artworks can surge in popularity, their long-term cultural impact is harder to measure. For investors, distinguishing between speculative hype and enduring value is essential.

Your options and how to decide

So, what does this mean for investors and collectors? Not every acquisition needs to be conceptual, controversial, or headline-making. However, Comedian serves as a reminder that contemporary art rewards those who understand its context.

Before acquiring a culturally disruptive piece, or any conceptual work, consider:

- Is the artist institutionally recognised or historically significant?

- Is the work part of a larger cultural moment or artistic dialogue?

- Is the scarcity structural (e.g. limited edition), or just temporary hype?

- Would the work still be desirable in five, ten, or twenty years, even if the market shifts?

At Zurani, we help clients explore these dimensions with care and consideration. We analyse market context, institutional momentum, and the collector’s own vision. That combination of insight and intuition is key to acquiring not just art, but legacy.

From fruit to fundamentals

Cattelan’s Comedian taught us something simple yet powerful: art markets follow their own logic. They’re driven by emotion, rarity, timing, and trust. And in some cases, by a banana taped to a wall.

Its $6.24 million sale in 2024 [1][2] shows that collectors and institutions will still pay extraordinary sums for works that challenge perception. But behind the headlines lies a more profound lesson. Understanding supply and demand in art isn’t about price predictions. It’s about understanding how narrative, scarcity, and symbolism influence value, extending far beyond materials.

As collectors, you’re not just buying objects. You’re curating meaning. And the proper guidance can help ensure that your acquisitions speak not only to the moment, but to your future.

To explore acquisitions that combine cultural significance with long-term value, speak to our team at +971 58 593 5523, email us at contact@zurani.com, or visit our website at www.zurani.com.

Sources

[1] artsy.net/article/artsy-editorial-maurizio-cattelans-duct-taped-banana-sells-62-million-sothebys

[2] theartnewspaper.com/2024/11/21/maurizio-cattelan-banana-sothebys-6-million-auction-comedian

[3] people.com/man-who-bought-duct-taped-banana-artwork-for-millions-eats-it-8753513