What is blue-chip art?

For many collectors, art begins with emotion, a moment of resonance, a connection to a story or a form. But as collections grow, so does the need for structure. That’s where blue-chip art comes into view. It offers more than prestige; it offers resilience, clarity, and a connection to the cultural canon.

Yet the term is often used loosely. What makes an artwork “blue-chip”? How do collectors use it as part of a broader strategy, and why does it matter more than ever today?

At Zurani, we guide clients through these decisions with care and consideration. In this article, we examine what blue-chip art truly means, its long-term performance, and the role it can play in a well-rounded collection.

How does it work in practice?

Blue-chip art refers to works by established artists with strong secondary market demand and sustained institutional attention. These are names like David Hockney, Yayoi Kusama, Jean-Michel Basquiat, or Gerhard Richter, artists whose works are held by major museums, consistently sell at auction, and remain culturally relevant across generations.

Collectors who invest in blue-chip art are not just purchasing a visual asset; they are also acquiring a valuable investment. They are investing in a network of value, including critical acclaim, historical significance, curatorial interest, and consistent market demand.

These artworks often carry seven- or eight-figure valuations and are considered relatively liquid within the art market. Auction data from 2023 indicate that blue-chip artworks account for more than 80% of the global art market value, despite representing only a fraction of the total lots sold [1].

How blue-chip art performs over time

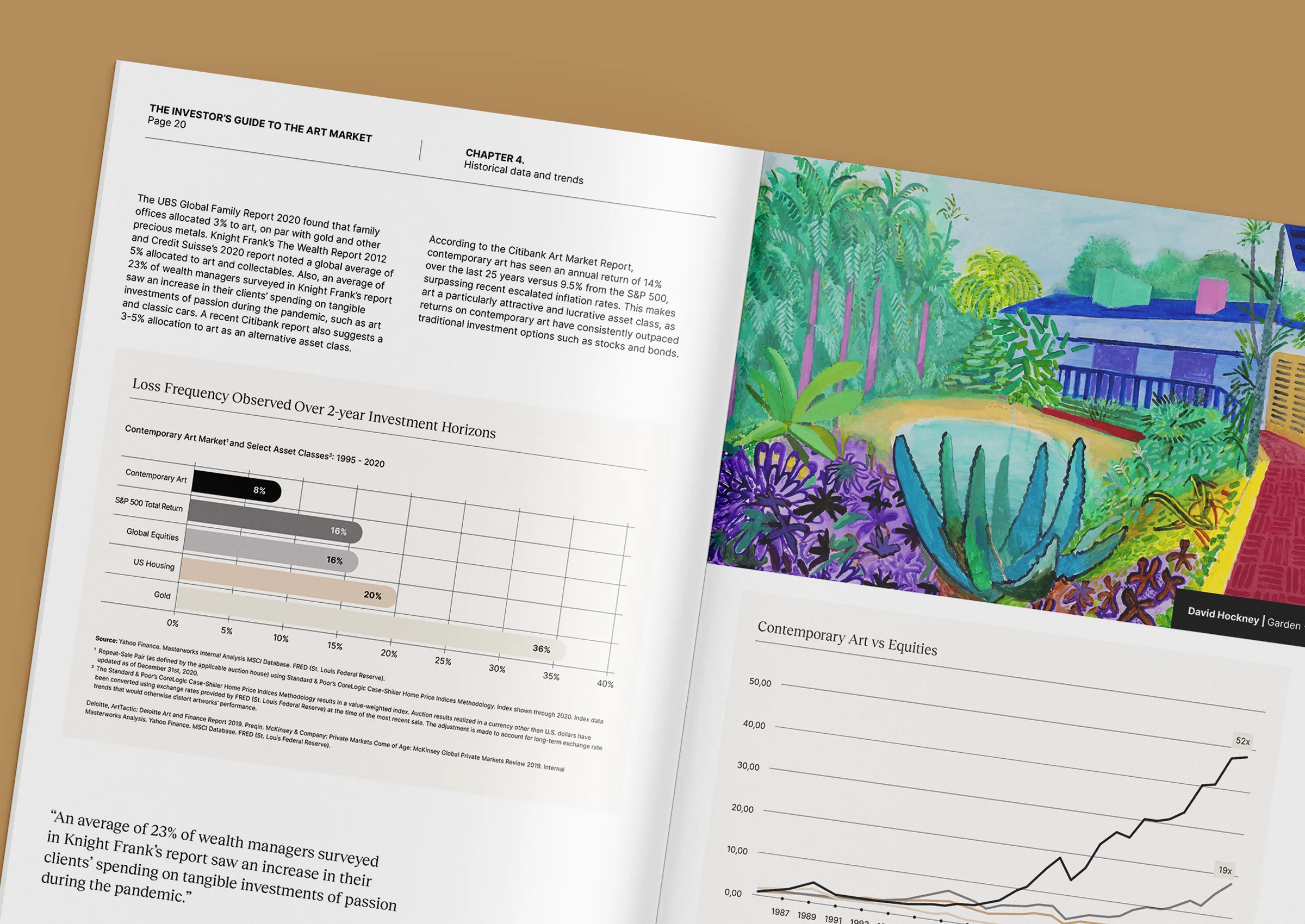

One of the key appeals of blue-chip art is its ability to weather market cycles. While contemporary emerging art may see dramatic spikes (and dips), blue-chip artists often deliver more stable returns over time.

For example, works by Gerhard Richter increased in average value by more than 380% between 2000 and 2022, with relatively low volatility compared to more speculative segments [2]. Similarly, works by Yayoi Kusama, once undervalued, have steadily appreciated as curatorial attention deepened and institutional exhibitions broadened her global reach.

During broader economic downturns, top-tier works tend to retain demand due to their cultural and historical weight. This gives collectors, particularly those seeking long-term capital preservation, a degree of confidence uncommon in other passion assets.

Key advantages and considerations

Blue-chip art investment isn’t just about market behaviour. It also offers significant benefits for collectors who value legacy, visibility, and cultural continuity.

Stability and resilience

Backed by sustained demand, these works tend to maintain their value and attract interest even in uncertain macro conditions.

Provenance and credibility

Blue-chip artworks often come with detailed records, catalogues raisonnés, and institutional backing, reducing acquisition risk.

Exhibition and curatorial appeal

These works are more likely to be loaned for exhibitions or featured in biennales, offering collectors cultural visibility and prestige.

Cultural legacy

Blue-chip art enables collectors to contribute to global heritage, particularly when works are displayed in private museums or family collections with public access.

That said, the entry point is high. And not every expensive artwork is blue-chip. At Zurani, we often advise clients to blend high-value acquisitions with strategically selected mid-career or emerging artists to balance financial and cultural potential.

Understanding the secondary market

The secondary market plays a crucial role in determining the classification of blue-chip stocks. Unlike primary market works (purchased directly from the artist or gallery), blue-chip art has already proven itself through repeated sales and consistent buyer interest.

Liquidity varies even within this segment. A Basquiat may sell within minutes at Sotheby’s; a lesser-known Hockney work may require months of private negotiation. The distinction often comes down to subject matter, scale, provenance, and condition.

That’s why our advisory process includes detailed provenance verification and a review of auction history, helping clients understand not only what they’re buying, but also how it may perform if resold.

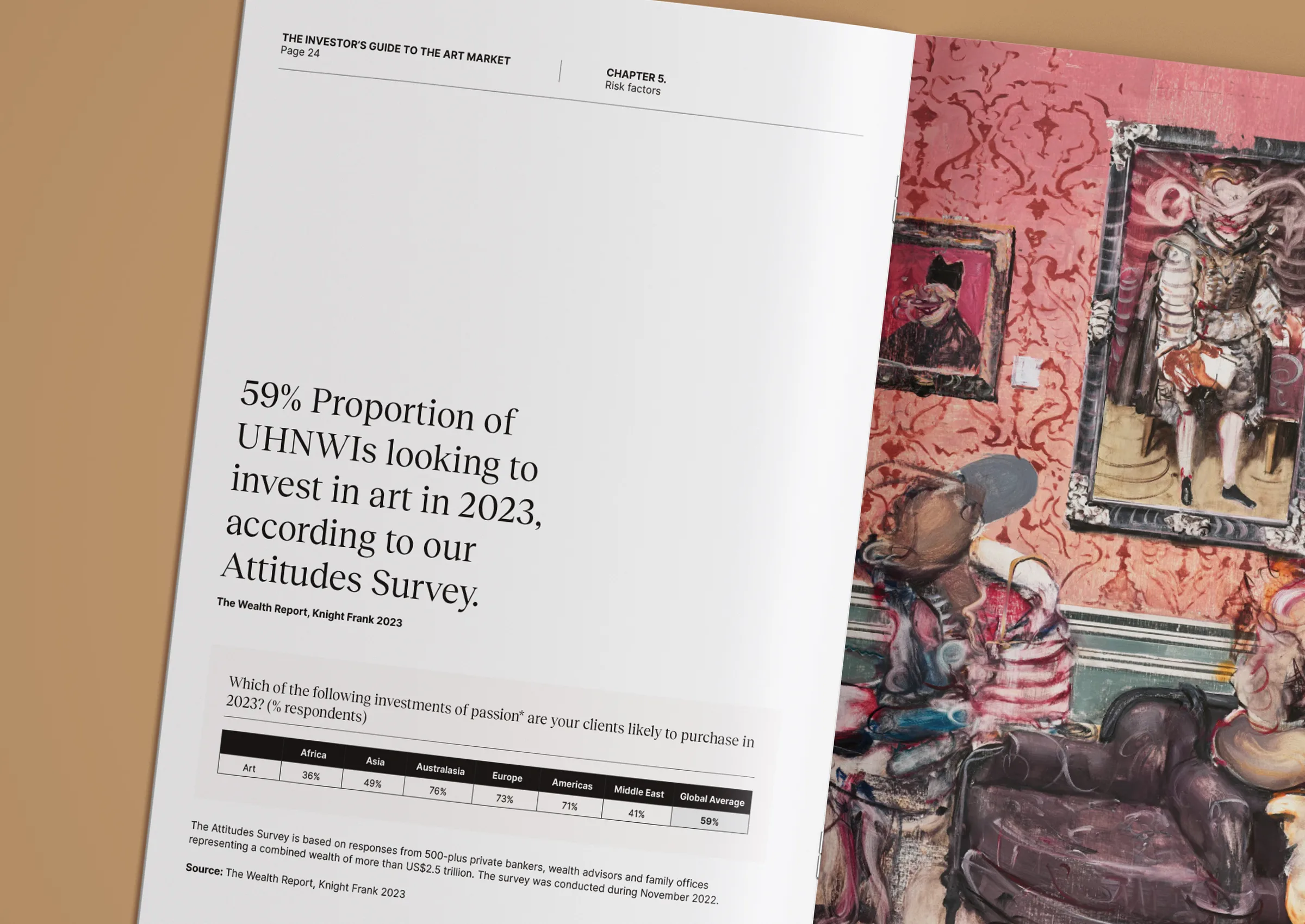

Why this matters in the Middle East and Asia

Collectors in the Gulf and Asia are increasingly investing in blue-chip art not only for financial reasons, but for cultural positioning. Institutions such as the Louvre Abu Dhabi, Mathaf: Arab Museum of Modern Art, and the National Gallery Singapore are all actively acquiring and exhibiting works by global blue-chip artists.

Owning such works signals alignment with international standards of taste and connoisseurship. It also opens doors to global partnerships, museum loans, and cross-cultural programming.

At the same time, many regional collectors are combining blue-chip acquisitions with significant works by Middle Eastern and South Asian artists, thereby building collections that are both globally relevant and locally grounded.

Making the right decisions

Ultimately, blue-chip art investment is about more than safe bets. It’s about thoughtful positioning. These works provide anchor points, intellectually, financially, and culturally. They help define a collection’s core and offer the kind of depth that stands the test of time.

At Zurani, we believe every acquisition should serve a purpose. Whether you’re acquiring a Richter for a legacy collection or a Kusama to exhibit publicly, we help ensure the decision aligns with your values and vision.

To explore blue-chip acquisitions with long-term cultural significance, speak to our team at +971 58 593 5523, email us at contact@zurani.com, or visit our website at www.zurani.com.

Sources

[1] artmarketresearch.com/blue-chip-art-index-2023

[2] masterworks.com/research/richter-kusama-long-term-performance-analysis