The growing influence of mid-tier collectors in today’s art market

In 2025, the global art market remains resilient, with total sales estimated at US$57.5 billion in 2024, a 12% decline from 2023. However, transaction volumes grew by 3 per cent, indicating sustained engagement, especially in lower price tiers [1]. While headline-grabbing auctions dominate headlines, the real force behind the market’s stability lies with mid-tier collectors, those acquiring works between $50,000 and $500,000.

Market resilience built on steady demand

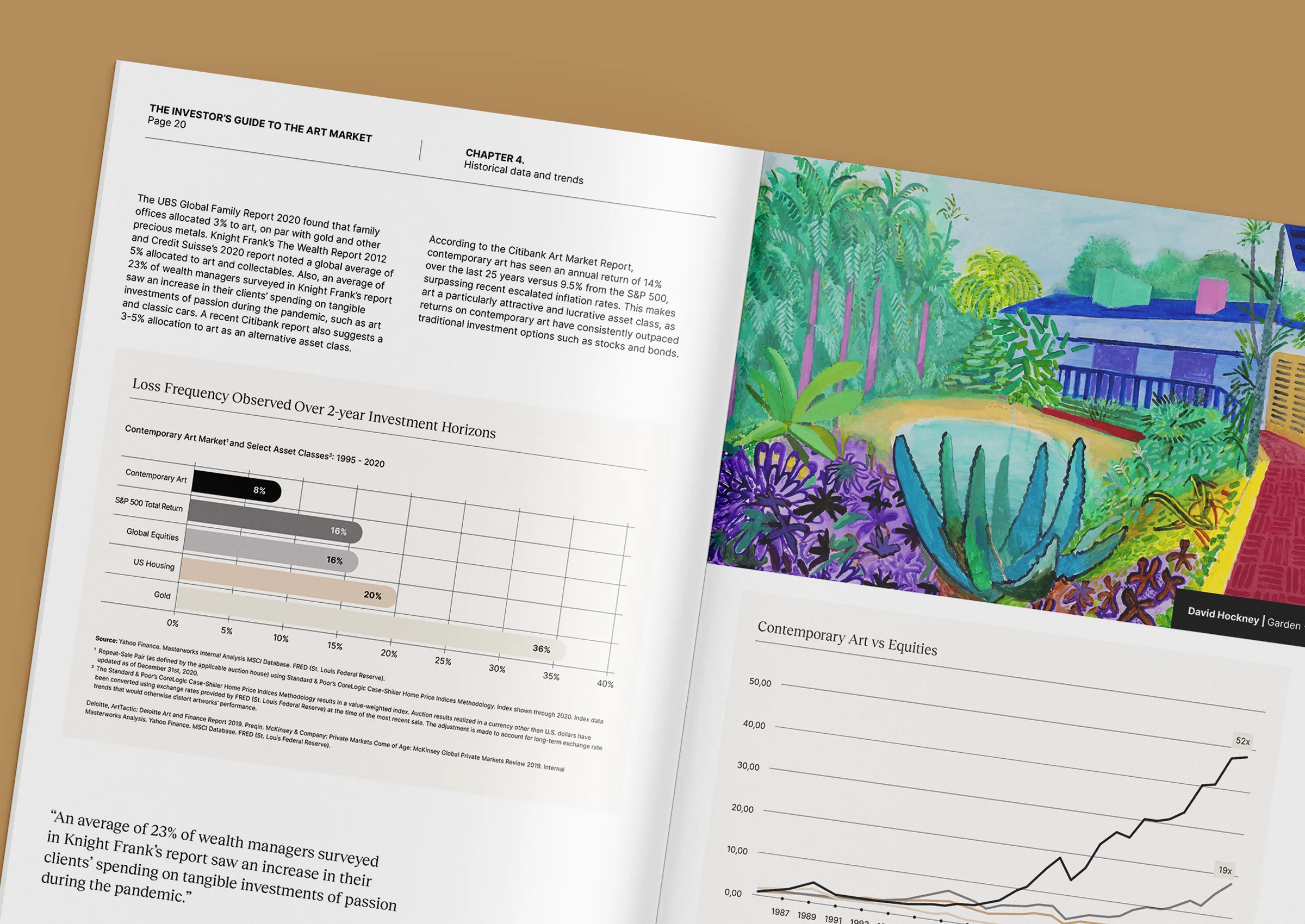

Headline sales for trophy pieces may have softened, but the broader market remains stable. Dealers with turnover under USD 250,000 reported a 17% increase in annual sales, and auction lots priced below $5,000 experienced both value and volume growth, indicating that fine art continues to change hands, albeit at different price points [1]. This consistent demand from mid-tier collectors sustains galleries and supports cultural ecosystems, providing stability that is absent in the volatility of ultra-high-end auctions.

Why mid-tier matters more than ever

Mid-tier collectors offer a compelling blend of passion and strategy. Their acquisitions, significant yet accessible, enable them to engage repeatedly with the market, building portfolios over time. As dealers observe consistent mid-tier sales, this group supports artists and galleries in a sustainable manner. While data on precise mid-tier share is limited, trends point to its growing importance as a stabilising force in the broader market [2].

Shaping the future through access and opportunity

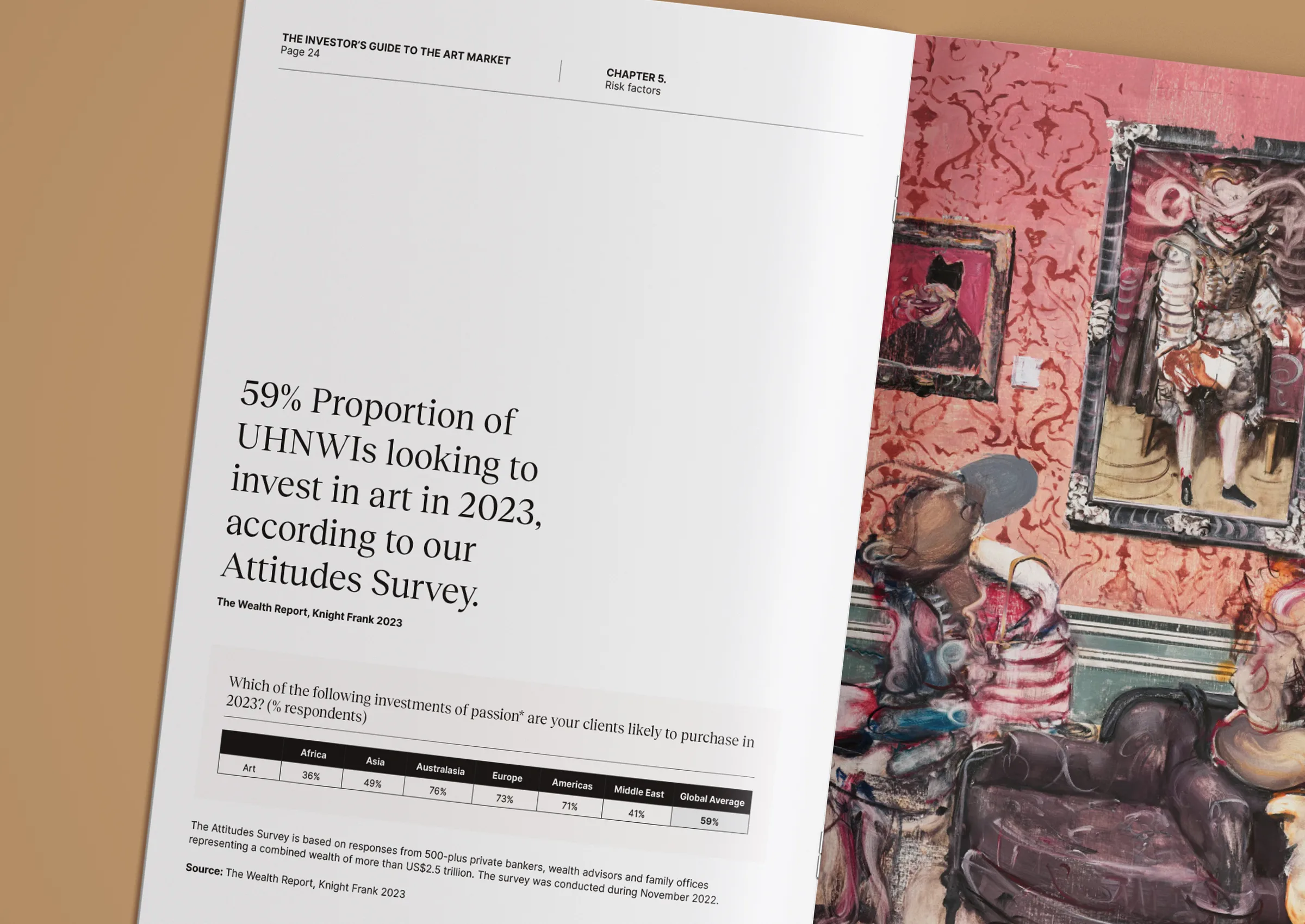

Emerging regional markets, particularly in the Middle East, South Asia, and the Asia-Pacific, are witnessing mid-tier collectors elevate local talent onto the international stage. These collectors’ support carries cultural weight, driving institutional interest and giving artists from these regions greater visibility, often through curated, meaningful acquisitions rather than speculative spending.

Private sales and relationships take centre stage

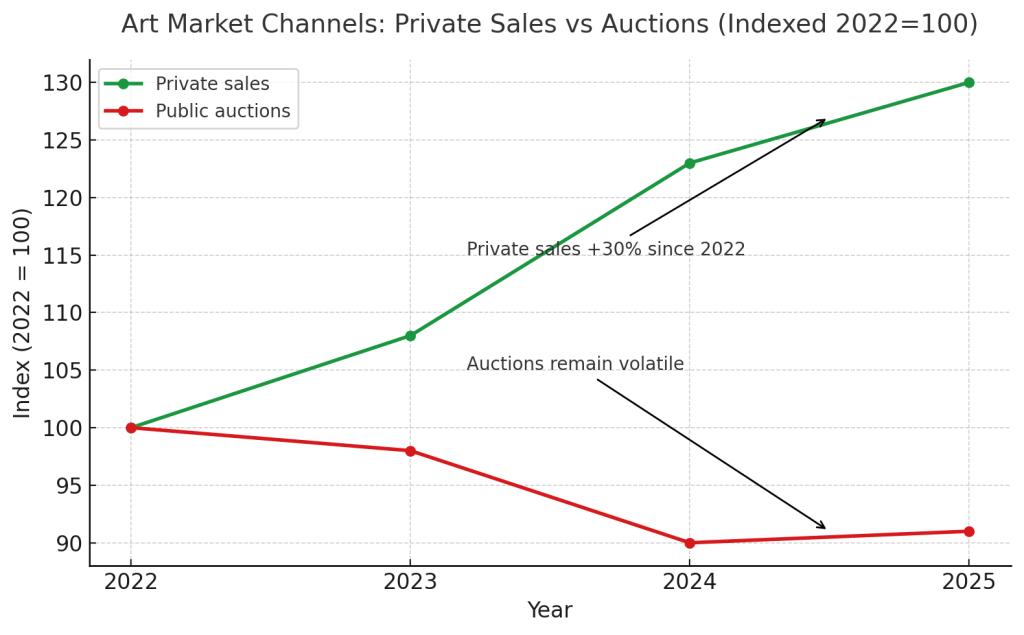

Many mid-tier buyers favour private channels over public auctions. In 2024, private sales via auction houses rose by 14%, reflecting demand for discretion and curatorial support [2]. This mirrors broader wealth-management trends, where trusted advisors guide acquisitions, offering pricing flexibility, strategic fit, and deeper relationships. These qualities make mid-tier acquisitions particularly suited to private, relationship-centred deals.

Looking ahead with confidence

The mid-tier’s future looks promising. Younger collectors, particularly Millennials and Gen Z, are entering the market in increasing numbers, often beginning with mid-range acquisitions. Digital tools, including blockchain-enabled provenance, enhance transparency and reduce risk, qualities that mid-tier buyers value [2]. As regions such as the Gulf invest in cultural infrastructure, mid-tier collectors gain both access and influence in markets characterised by growth and recognition.

At Zurani, we understand how mid-tier collectors are quietly shaping market momentum. Whether you’re building a thoughtful collection or refining your strategy, we offer meaningful guidance that aligns cultural passion with investment clarity.

Contact us at +971 58 593 5523, email contact@zurani.com, or visit our website at www.zurani.com.

Source data

- Art Basel & UBS Global Art Market Report 2025: In 2024, global art market sales were estimated at USD 57.5 billion, a 12% decrease, while transaction volume grew by 3%. Smaller-dealer sales increased, and auction lots under $5,000 rose in value and volume [4][2].

- Global Art Market Report 2024–2025 (Marcin Frąckiewicz): Online platforms and private sales grew in importance; private transactions rose by 14% in 2024, emphasising the rise of private channels [2].