Why art is becoming a cornerstone of family office legacy planning

For many family offices, art is no longer seen solely as a passion or a discretionary holding. It has become a core legacy asset, one that embodies both financial value and cultural identity. As families plan across generations, art plays a unique role in preserving wealth, enhancing reputation, and creating a tangible link between heritage and future vision.

Beyond investment to legacy

Unlike other asset classes, art carries meaning that transcends numbers on a balance sheet. A collection can embody a family’s story, taste, and values, while still functioning as an appreciating investment. Unlike equities or real estate, art offers cultural capital, the prestige of patronage, institutional recognition, and public visibility. For family offices, this blend of value and symbolism makes art a powerful intergenerational tool.

Succession planning through collecting

Family offices often manage wealth with a long horizon. Art fits seamlessly into this model. Works can be passed across generations, providing both financial continuity and a shared cultural reference point. Structured correctly, collections can be integrated into trusts or foundations, ensuring artworks are preserved, curated, and aligned with a family’s broader philanthropic or cultural ambitions.

Succession is not simply about inheritance; it is about education and stewardship. Younger generations are increasingly involved in collection planning, shaping acquisitions around both personal identity and global awareness. This makes art a bridge between tradition and modernity within the family unit.

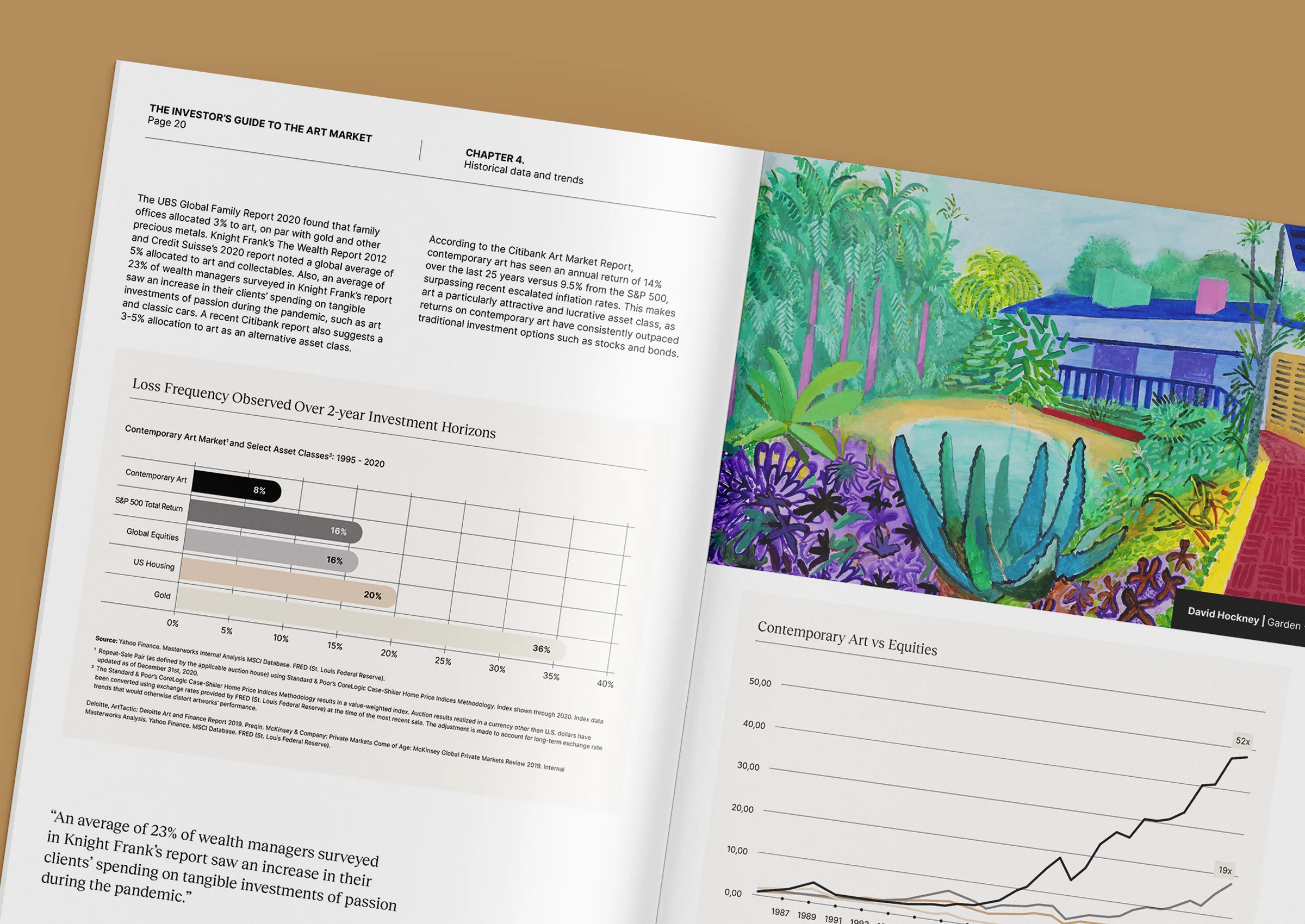

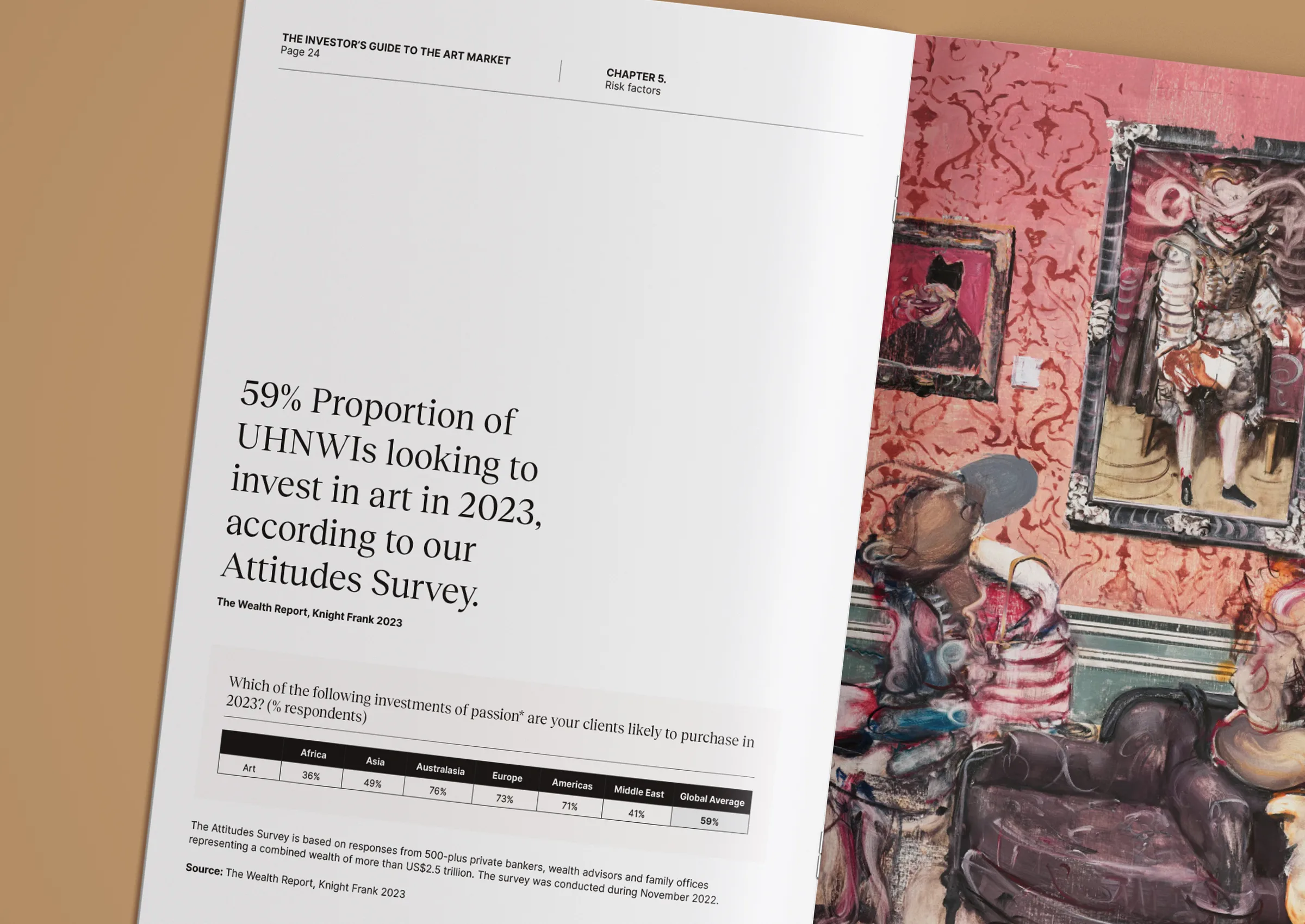

Diversification and preservation of wealth

Art’s role as an alternative investment is well established. It is uncorrelated with traditional markets and can act as a stabiliser during periods of financial volatility. For family offices with large portfolios, art offers diversification alongside tangible ownership. Blue-chip works provide stability, while carefully chosen emerging artists can deliver growth potential.

Unlike cash or securities, art can also be enjoyed — displayed in homes, offices, or loaned to museums. This unique duality of utility and investment adds to its appeal as a preserved, lived-in asset.

The role of private sales and advisory

Family offices often prefer discretion, making private transactions particularly attractive. Working with trusted advisors ensures access to opportunities not available at auction, along with the careful due diligence required for long-term legacy planning. Provenance, authenticity, and valuation are key considerations, not only for current financial security but for the stability of future succession.

Advisory also supports long-term portfolio management, ensuring collections remain balanced between financial performance, cultural value, and family vision.

Shaping identity across generations

Ultimately, art as a legacy asset is not only about financial strategy. It is about shaping identity, embedding cultural presence, and connecting generations through shared appreciation. For family offices in the Gulf and across Asia, where cultural investment is becoming more central to national identity, art’s role as a legacy asset is both personal and societal.

By curating with intention, families create collections that not only grow in value but also serve as markers of influence, vision, and continuity long into the future.

At Zurani, we work closely with family offices to ensure art collections serve both financial and legacy goals. From acquisition and structuring to long-term stewardship, our advisory services are tailored to each family’s vision.

Contact us at +971 58 593 5523, email contact@zurani.com, or visit our website at www.zurani.com.