The rise of digital provenance in art collecting

Trust has always been at the heart of collecting art. A work’s provenance — its chain of ownership and documentation — is what gives collectors confidence in authenticity, value, and long-term significance. Yet traditional methods of record-keeping, often reliant on paper archives and personal relationships, are vulnerable to gaps and disputes. In recent years, digital provenance has emerged as a transformative solution, offering collectors greater certainty and transparency than ever before.

What digital provenance means for collectors

Digital provenance refers to the use of technology, particularly blockchain, to create secure and immutable records of ownership and authenticity. Every transaction, from an artist’s studio sale to a transfer through private hands, can be logged in a way that cannot be altered or erased. For collectors, this means a clearer history, reduced risk of forgery, and greater confidence when acquiring works in both primary and secondary markets.

Unlike NFTs, which attach digital certificates to digital artworks, digital provenance is broader. It applies to both physical and digital art, enhancing the infrastructure of collecting without altering the essence of what is being collected.

Why technology matters for investment security

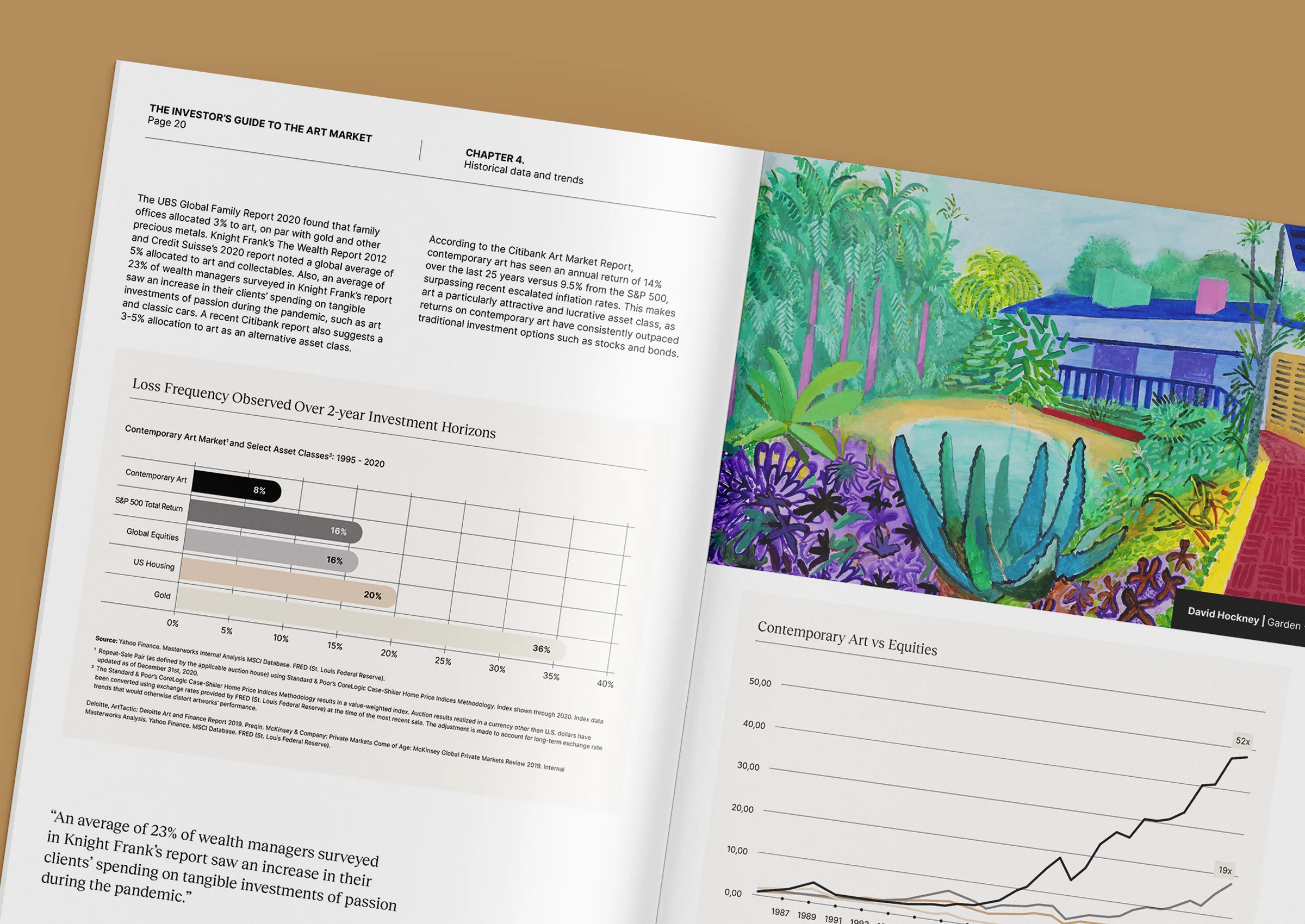

For family offices and private collectors, art represents both passion and long-term capital. Disputes over authenticity can erode that value quickly. By embedding provenance into secure digital systems, collectors protect not just the current market value of a piece but its ability to retain and grow that value across generations.

Insurers and lenders are also increasingly supportive of blockchain-backed records, viewing them as a means to streamline underwriting and mitigate risk. As art becomes more integrated with wider wealth strategies, the assurance of digital provenance is becoming essential.

Private sales and transparency

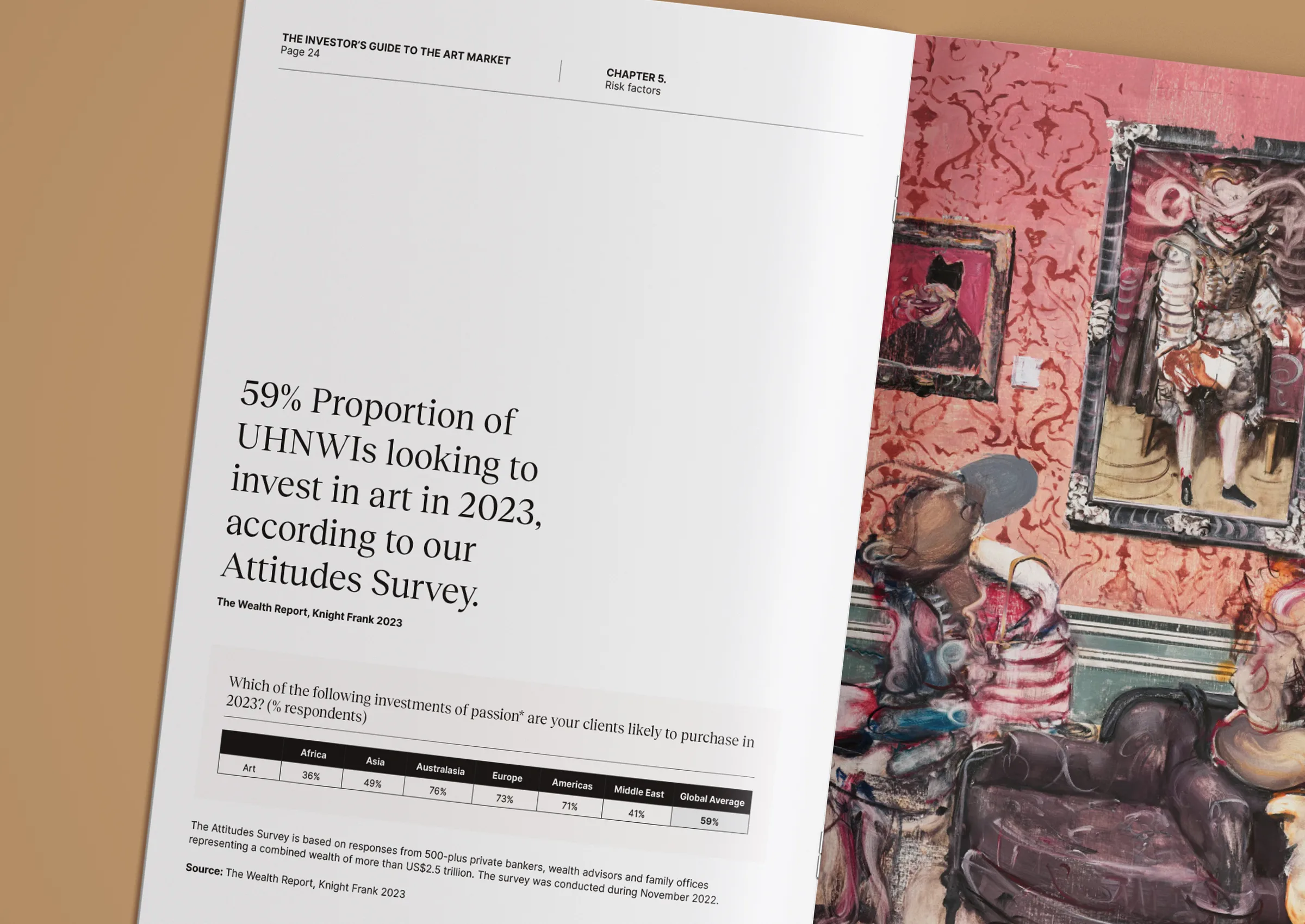

Private sales are a growing part of the global art market, particularly in the Gulf and Asia. These transactions often prioritise discretion, but they also rely heavily on trust. Digital provenance bridges the gap: collectors can engage privately while still benefiting from robust records that safeguard value. This blend of confidentiality and transparency is particularly attractive to family offices and institutional buyers seeking stability.

Adoption across the art ecosystem

Leading galleries, auction houses, and advisors are increasingly embracing digital provenance systems. Some institutions are already collaborating with blockchain providers to record new sales at source, ensuring a reliable record from the moment of acquisition. Museums are also experimenting with blockchain-backed archives, further embedding digital provenance into the cultural landscape.

As adoption grows, collectors who embrace these tools early position themselves ahead of the curve. Not only do they protect their own assets, but they also help shape a future market where trust and efficiency are significantly enhanced.

Looking ahead

Digital provenance is not a passing trend. It is part of a broader movement to align the art market with the expectations of global wealth management, characterised by clarity, traceability, and reduced risk. For collectors, it offers a way to combine passion with prudence, ensuring that works acquired today retain both cultural resonance and financial integrity for decades to come.

At Zurani, we guide clients through the evolving landscape of digital provenance, advising on acquisitions, due diligence, and long-term stewardship. Whether you are looking to secure your first blockchain-backed work or integrate digital records into an existing collection, our team can help you navigate with clarity and confidence.

Contact us at +971 58 593 5523, email contact@zurani.com, or visit our website at www.zurani.com.